The Best Bookkeeping Software for Small Business Owners

Small business owners already have a lot on their plate. They wear a lot of hats, from marketing to operations and even finance! While taking on more and more tasks can be possible, it’s not always sustainable. Owners should be smarter with how they use their time. One way to do that is by using bookkeeping software to make the routine yet daunting task more manageable.

If you’re unfamiliar with this essential tool, let us help you! We’ve compiled the best bookkeeping software for small business, their key features, and other factors you need to take into consideration.

Why use a bookkeeping software?

A bookkeeping software can be your partner in achieving financial health and future business success. Here are some of the top reasons why using bookkeeping software is a good investment for small business owners like you:

-

Reduce human error and stay organized

Keeping accounting records the old-school way exposes your business to human error. This isn’t ideal if you want your finances in check. A small error like a misplaced comma or zero can drastically change your financial reports. And when you accidentally lose or throw away an invoice, that record will be difficult to recover.

The right bookkeeping tool will have the features to help you address those concerns. Features like automated computations for taxes and financial reports can help reduce errors from manual computation. Bookkeeping programs also allow users to scan financial documents like receipts and then keep the data in a secure cloud storage system. This way, you have more accurate records while retaining two copies of your documents that you can access when needed.

-

Save time and increase productivity

Bookkeeping can be deceptively time-consuming. However, working with the most suitable software helps. It helps cut down by providing easy-to-use reporting templates and automating computations.

-

Better financial management

Good bookkeeping contributes to better records and more informed financial management methods. When you have accurate and organized reports, you can make more sound and data-driven decisions for your business.

-

Compliance and reporting

To stay operational, you need to comply with the laws and regulations that cover your business. With the best software for bookkeeping small business owners don’t have to spend hours and hours extracting reports needed for audits and tax filing. This allows them to remain legally compliant without sacrificing their time for other core functions.

-

Scalability

As your business grows, so will your data management and financial record-keeping needs. The most suitable bookkeeping software will be able to adjust to your evolving needs. You can consider starting off with a free version with the most basic functions. Then, as your business grows, you can add more features you’ll need along the way.

-

Data security

The best bookkeeping software is also the most secure one. You can use these tools to keep accurate and real-time records safely and away from cybercriminals and external threats.

Need help monitoring your finances? Hire a bookkeeping virtual assistant today! Book a free consultation call to know more.

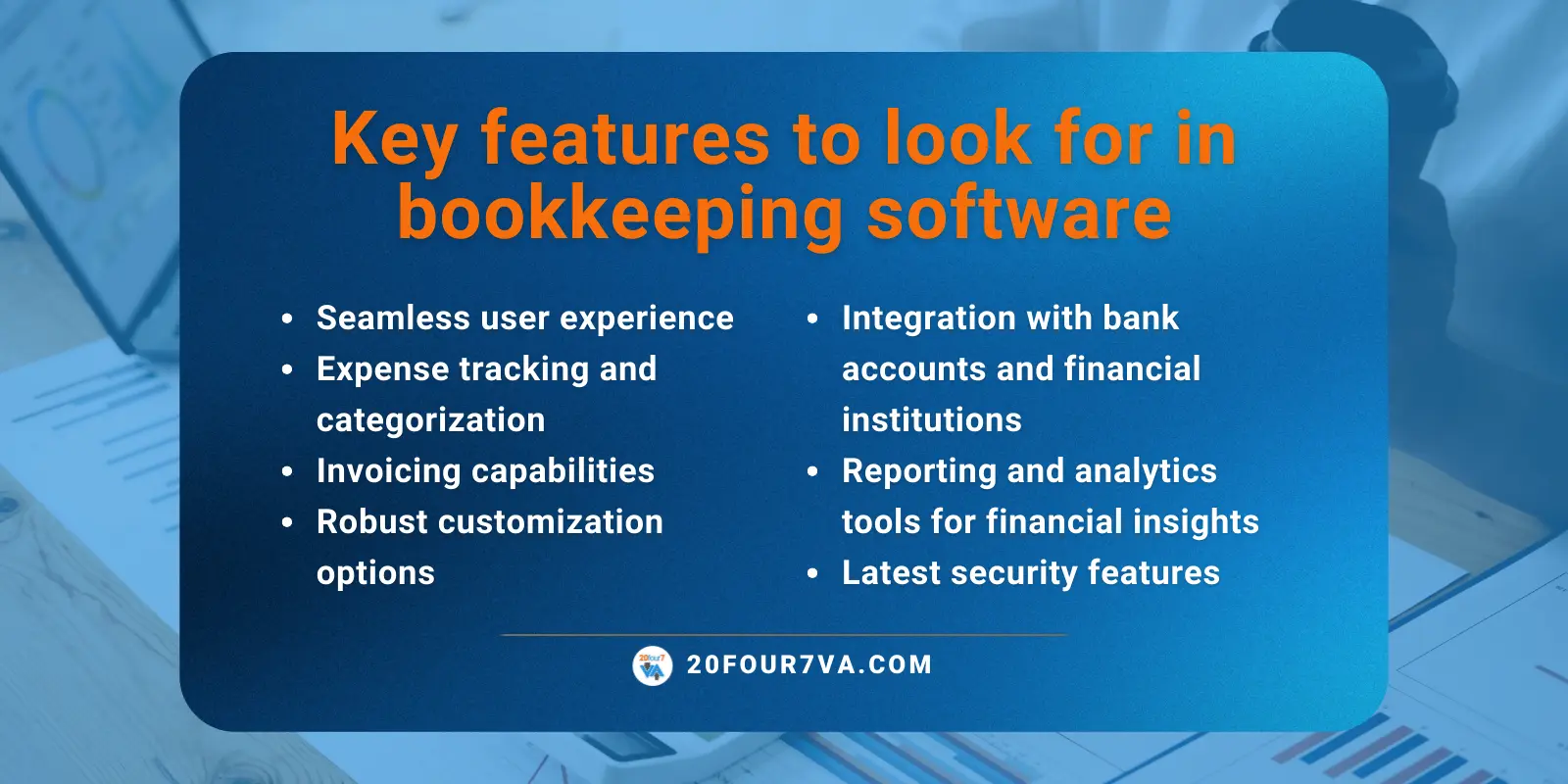

Key features to look for in a bookkeeping software

Not all bookkeeping tools are made equal. Some may seem more feature-packed but can turn out to be too pricey with unnecessary functions. Some can seem basic but may just be what your business needs. There are plenty of options out there, so it’s best to take some time to do some research and trial runs before fully committing.

-

Seamless user experience

A smooth and easy-to-navigate software is a critical factor when choosing a software. You’re using a tool to make your life easier, not to confuse you further with difficult-to-understand functions and user interface.

Look for a software with intuitive navigation that even beginners can pick up with not much problem. A clean-looking dashboard with straightforward functions and logical structure will make the task of bookkeeping much simpler and less daunting.

-

Expense tracking and categorization

Bookkeeping requires you to handle plenty of data. You need a software that can make data management more effective. Look for features that allow you to easily streamline processes, from data entry to expense reconciliation. Such features include receipt scanning, automated bank feeds, and rule-based transaction categorization.

-

Invoicing capabilities

Software with invoicing capabilities won’t just help you streamline another process in your operations; it also enables prompt payment collection. Generating fast and accurate invoices means you can communicate your receivables much quicker. It also lessens the back and forth with clients because they’ll be able to understand your automated invoices easily and, in turn, process their payments faster.

-

Robust customization options

Each business has unique needs. It’s important to consider whether or not an option offers the ability to tailor-fit its solutions for your business. Customizable charts of accounts, invoice templates, and expense categories enable you to structure financial data in a way that makes the most sense for your business. Personalization of reports and dashboards ensures you can easily access the data and reports that matter most to you.

Another essential feature is the customizable user permissions or access levels. This is an added guardrail to ensure that your sensitive financial data is only available to those who need to access it.

-

Integration with bank accounts and financial institutions

Seamless integration between your software of choice and your bank accounts can save you a lot of time. When you use software that’s synchronized with relevant financial institutions, you can minimize the risk and lessen the time involved in the manual data entry and reconciliation processes.

This feature also enables real-time updates. You can see your accounts’ balances, credit and debit expenses, and other banking activities. This provides better visibility and helps you swiftly decide whether or not you should adjust your financial strategy.

-

Reporting and analytics tools for financial insights

Ideally, your bookkeeping tool is more than just a platform to record your finances. It will also be your partner in achieving your business’ financial goals. Your software should have a robust reporting system and analytics tools to provide the insights you need to make more sound financial decisions and improve your forecasting efforts.

Look for a tool that helps you generate reports of specific time periods, departments, or projects to enhance flexibility. Additionally, visual analytics, including graphs and charts, can simplify complex financial data, making it easier to interpret and share with stakeholders and team members.

-

Latest security features

Your financial data should be treated with utmost confidentiality. While you want a tool that’s easy to use and intuitive, you should also look for one that is as secure as possible. Look for software that offers advanced encryption and role-based access controls.

Be meticulous when choosing your bookkeeping software. Ensure that your selection adheres to industry-leading standards as well as data backup and recovery options.

Make the most out of the best software for small business bookkeeping by hiring a Bookkeeping Virtual Assistant! Contact our Growth Experts to get started.

20four7VA picks: best bookkeeping software for small business owners

Here are our top bookkeeping software picks you may want to consider for your own small business!

-

Quickbooks

Many consider Quickbooks to be the best online bookkeeping software for small business owners. It’s an intuitive software that even those without an extensive accounting background can use comfortably. It has plenty of features to offer, from excellent inventory management to customizable reports. For those on the go, Quickbooks also offers a mobile accounting app to keep track of your finances even when you’re away from the office.

Why you should use Quickbooks:

- Packed with features

- Mobile app

- Scanning and organizing of physical receipts

- Security and data privacy safeguards

Why Quickbooks may not be for you:

- You prefer software with the most basic features

- No free plan

- Plans can be on the expensive side (VIEW PRICING)

-

Freshbooks

What makes Freshbooks a top choice for us is its simplicity—in terms of both the aesthetics and the general workflow. It ranks high in terms of the user experience. Newbie bookkeepers will have almost zero qualms about learning how to navigate this tool. Aside from invoicing and reports management, Freshbooks also offers Freshbooks Payroll, which is a paid add-on that enables faster and more accurate payroll disbursement.

Why you should use Freshbooks:

- Cloud-based

- User-friendly

- Supports third-party app integration

- Excellent invoicing

- You have a small or one-person accounting team

- Service-based business

Why Freshbooks may not be for you:

- More clients means a higher plan tier

- Adding users to your account will cost you (VIEW PRICING)

- Inventory management features may seem lacking for product-based businesses

-

Zoho Books

Looking for the best free bookkeeping software for small business owners? Zoho Books can be a great option. The cloud-based accounting software offers five paid plans. But they also have a free version that can be great for those who want to start off with the most basic features. It offers a high level of customizability but can seem a little complex for those unfamiliar with bookkeeping tools.

Why you should use Zohobooks:

- You want a free version for basic but effective bookkeeping

- Invoice management

- Multi-language support

- Vendor portal (for select plans)

- User-friendly interface

- You have a growing or established business

Why Zoho Books may not be for you:

- You find too many features overwhelming

- Additional charge for document scanning and conversion

Ready to fine-tune your financial strategy ? Start by hiring a Bookkeeping Virtual Assistant! Get in touch with our Growth Experts to learn more!

So, should you invest in bookkeeping software?

Bookkeeping is an essential task for any type of business. That’s why you need to be meticulous when choosing the software you’ll use to accomplish this task. The right bookkeeping software will not only help you save time but can also improve financial management efforts and ensure you have the most accurate financial records.

Hopefully, the above tips can help you make the right choice for your business. Make sure to check an option’s security, accounting, and customization features. And if you want to narrow down your list even more, simply check out our top 3 picks!

[activecampaign form=68]