3 Lesser Known Business Growth Strategies That Work

The growing phase of your business demands a new set of perspectives, tactics, and skills. Even the goals that you set when you were just starting an online business will be replaced by more demanding ones when you’re set for expansion. While business growth means different things for different entrepreneurs, the one thing they have in common is this: a need for creativity and guidance.

Without these, opportunities for growth may turn into misses.

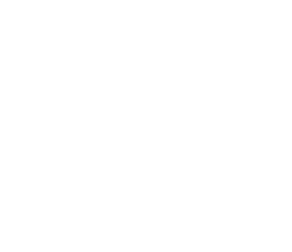

A study on startups has revealed that these factors stunt business growth and might even lead to its eventual closure:

- Insufficient market need – 42%

- Lack of financing support – 29%

- Inappropriate Staffing – 23%

- Inability to cope with competition – 19%

These figures can definitely evoke fears and uncertainties. Are you really equipped to handle a growing company? Is your business strong enough to handle growth? Are your plans, ideas, and current team configuration conducive for expansion?

Driving New Business Development: How to Strategically Position Your Company for Growth

A lucrative business does not happen by accident. Success in business is usually backed by a network of e-commerce support, sufficient talent, and creativity. It is good to heed traditional advice such as spreading your money across different investments and focusing on customer satisfaction. However, if you want a head start from your competition, you need a more ingenious line of attack.

Check out these 3 business growth strategies you might not know yet:

- Prioritize Customer Retention

Even before looking at fiscal reports, entrepreneurs already have a way of knowing that their business is ready to scale up. An influx of potential clients is often one of the most obvious signs that a company is growing. Predictably, entrepreneurs focus their efforts on winning these prospects.

So, they fund ads that will turn web traffic into paying customers. They run social media campaigns that heap discounts upon discounts on new subscribers. In the thick of this game plan, existing customers are shelved. Make sure you never make this mistake.

Prioritize customer retention even with a throng of new prospects coming your way. Retention Science CMO co-founder and CEO Jerry Jao insists that customer retention efforts should outweigh new client acquisition. Why? Because existing customers pay more and are highly likely to buy again. They are also inclined to vouch for a brand through word-of-mouth recommendations.

Here are a few ideas to help you take better care of your current clients:

- Reward your highest-paying or most profitable buyers. CRM data will show which customers have the highest spending or made the most purchases at a given period. Reward these buyers with discounts, freebies, or first dibs on your new products. You can also feature them on your blog, Facebook, Twitter, or Instagram page to reward them with 15 minutes of fame.

- Reach out to inactive subscribers. Watch out for formerly active clients who have recently gone idle. They could be shopping around for similar brands or have already taken their business elsewhere. Reach out to inactive clients by reminding them of membership perks or presenting them with discounts. This would also be a good time to bring up unused subscription points or coupons in their account.

- Personalize follow-up emails. Some customers browse through your product list, add items to cart, and leave without buying anything. Some inquire about services without pursuing reservations. When customers express interest but fail to take action, send follow-up emails immediately. Make sure to curate your emails with deals featuring their desired services. You can also propose upgrades based on their purchase history.

- Hire People Based on Talent and Sustainability

The prospect of a mounting workload is enough to prompt business owners into hiring more people. Often, they rush to fill up vacancies without considering if a person is fit for the role or the company. Premature recruitment may also lead to overstaffing or overspending on human resource.

When your business is growing, don’t let the urgency of work rule your judgement in recruitment. Don’t just fill up positions based on present needs. Instead, consider long-term repercussions when recruiting new associates. This means evaluating the talent and cultural fit of candidates while taking your financial plans into account.

Outsourcing to a Virtual Staff: Why It’s the Best Option

For growing businesses, remote staffing is the best way to expand the workforce.

Just think about it: while you need more people to meet your growing needs, you don’t need to pay for more equipment or office space. While you need specialists to take care of marketing, accounting, and design, you don’t need to do the extra legwork or spend on training costs.

By utilizing virtual assistant services, you can boost productivity without inflating your expenses along the way. Thanks to staffing companies such as 20Four7VA, you can work with experts without blowing your budget on relocation, training, or remuneration fees.

You hit both talent acquisition and sustainability when you hire a virtual assistant (VA). Here are more ways a virtual assistant can help your business scale up:

- Curate Better Content. Your brand goes through different phases in its lifetime – and in each level, quality content is always essential. You need a Content Writer VA who will help you conceptualize and write engaging blog posts, create clear and enticing product descriptions, and compose social media posts that drive website traffic. To get a better website ranking in Google, you must first work on getting better content.

- Take Care of Administrative Work. Efficient admin work keeps daily operations smooth and stable, but answering emails, organizing files, and doing data entry can be time-consuming. It can rob you of the energy you need to come up with creative and inspired ideas to improve your brand. As the business owner, your hours and energy are better spent on developing your products or expanding your connections. Getting administrative support can go a long way in increasing your productivity.

- Boost Social Media Presence. Years ago, consumers research a product by consulting friends or going on Google. Today, they check out social networks instead. According to Lyfe Marketing, using social networks is one of the most popular online activities with 37% of consumers looking for purchase inspiration from social sites. Imagine the magnitude of audience and conversions your brand will get when you perform well in these channels. A social media VA can help you there.

- Optimize Resources Exclusive for Small Businesses

One of the best things about running a small business today is the plethora of financing resources at your fingertips. You are no longer at the mercy of loan sharks and banks. You no longer need to shell out your savings or borrow from family or friends. But just like any other business aspect, choosing financing assistance must be done with caution.

Check out which funding options are best suited for your needs:

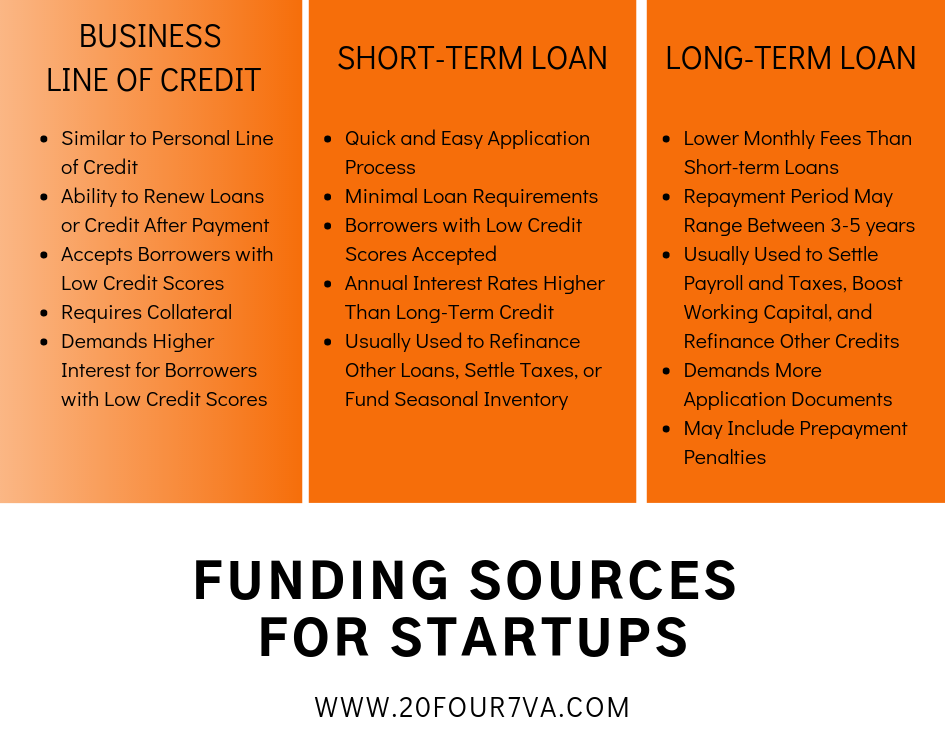

- Business Line of Credit. Renewability is perhaps the greatest advantage of this funding option. Entrepreneurs can withdraw funds after their previous credit has been settled. This financing assistance is even available to people with low credit score. The catch? Collateral requirement and higher interest rates.

- Short Term Loan. Short term business loans are straightforward. You borrow a specific amount of cash and agree to pay it back with the interest and lender’s fee over a predetermined period. Financing is available for different needs such as capital for seasonal inventory or real estate expansion. The interest rates of short-term business loans are significantly higher compared to long-term credit.

- Long Term Loan. Also referred to as Term Loan, Long term business financing has a repayment period of 3-5 years. Term loans also work like conventional funding assistance: a company takes out a specific amount of money and agree to pay it within the repayment period along with the interest rates and creditor fees. Most entrepreneurs use this to settle payroll and tax requirements, refinance other credits, and bolster working capital.

Besides financing aid, there are also tools and software specifically designed to support small businesses. Why spend on expensive technology curated for big company needs when there are free or cheap options for startups?

Improve team communication, customer relationship, and overall brand appeal with these business-forward tools:

- HubSpot CRM. There are many Customer Relationship Management software in the market but the HubSpot kit landed the 2018 Expert’s Choice spot. Using the software is free with higher packages starting at $50/month. Free features of the CRM kit include a dashboard for lead analytics and flow, contact activity, management, and insight, and collected contact forms.

- Slack. Tired of switching from one app to another to communicate and work with your virtual team? Slack lets you work in a comprehensive platform where you can chat, share files, and make video calls. Slack is also free, with higher plans ranging between $8-$15 per monthly user only.

- Freshdesk. An e-commerce support platform with internal gaming features, high customization, and integration of multiple major tools – this is what Freshdesk has in store for your brand. The free Freshdesk kit contains access to an email channel, knowledge base, basic social channel, phone support, and app gallery. Higher packages are at a starting rate of $25-$99 per monthly agent.

This is the point in your business when your choices can either take you further or upend your past investments. Follow these 3 lesser known business growth strategies to position your brand for development.