What You Need to Know About Small Business Financing

Some of the biggest brands today came from humble beginnings. The Amazon marketplace, which was started in a garage, now has an estimated value of $300 billion dollars and has catapulted its creator, Jeff Bezos, to his position as the wealthiest man in the world.

World-renowned motorcycle brand Harley Davidson may enjoy a luxurious reputation now but the first ever Harley bike was built in a wooden shed. These kinds of success stories are the ones that inspire so many regular people to follow their entrepreneurial dreams and make money from home – even if it means digging deep into their pockets.

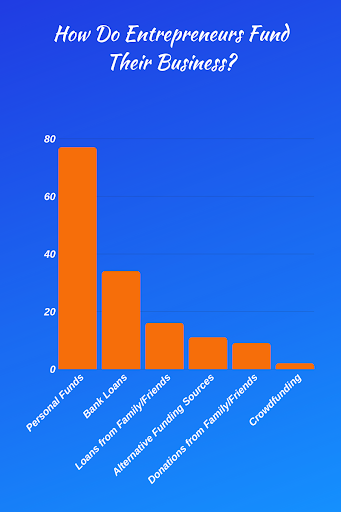

Statistics shows that business financing mostly comes from personal funds (77%), distantly followed by bank credits (34%) and loans from family and friends (16%).

Of course, this isn’t to say that entrepreneurs do not look for ways to fund their companies. The long list of requirements, significant collateral demands, and exorbitant interest fees that usually come with business loans discourage entrepreneurs to find other ways to fund their companies. While this is understandable, it can prove to be detrimental in the long run.

Where to Find Business Loans Besides the Bank

Is the lack of money keeping you from starting an online business or expanding? Are you afraid of racking up debts from loan companies? Do you think you’re unqualified for cash advances? Make sure that your fear of seeking financial support isn’t rooted from myths.

The following data will help clear your doubts or reservations surrounding business financing support – or the lack thereof:

- Cash flow trouble is the number one source of business failure

- Business loans have an approval rate of 62%

- Merchant loans have an approval rate of 79%

- 33% of small business owners have a high school or GED degree

- 29% of small business owners have bachelor’s degree

- 33% of startups have less than $5,000 capital

Money fuels a company. The lack of funding has kept many promising startups from reaching their full potential or even forcing them to cease operations. With high competition to consider, personal funds are no longer a reliable and adequate source of capital.

If you want to learn how to increase business growth, you must also learn where to get financing support – especially when business-related loans currently have a high approval rating.

Check out these 4 funding options for startup companies:

1. Small Business Loans. There’s no reason to accept lending terms made for big companies when there are platforms especially made for startups. Small Business Administration (SBA) is a federal agency built to help entrepreneurs get low-cost and long term funding.

How it works: The SBA gives incentives to lenders to approve loan applicants through 7(a) loan program, microloans, and 504/CDC loans.

- 7(a) loan option: the most flexible and popular SBA loan. Up to $5 million worth of loan is offered to borrowers for working capital, equipment purchase, debt repayment, or startup costs coverage.

- Microloans: advances for $50,000 or lower are given to entrepreneurs. As many banks refuse to provide microlending, SBA is the best source to get it. It is normally used for fulfilling inventory, purchasing supplies or machinery, and buying furniture or equipment.

- 504/CDC loans: usually used to finance major business needs such as real estate or high-cost equipment. 504/CDC loans feature low interest rates and payment period between 10-25 years.

2. Invoice or Accounts Receivables Financing. Sometimes, delinquent payments can derail a company’s day-to-day operations. If late-paying clients threaten your cash flow, invoice financing may be the best way to go.

How it works: Entrepreneurs get up to 85% of invoice values. For example, you have a transaction worth $10,000 that is payable in 5 weeks. However, you need the money now to continue operations or avoid cash flow issues. The Invoice Financing company will cash out 85% of the $10,000 invoice value ($8,500) for a weekly fee of 1% ($100) until the loan is paid. When the client pays you $10,000 in 5 weeks, you get $9,500 of the invoice.

BlueVine and Fundbox are two examples of lenders that provide invoice or accounts receivable funding. Usually lending money to B2B companies, these lending facilities require a small weekly fee in exchange for quick cash advances.

3. Business Line of Credit. This type of resource is best for entrepreneurs with seasonal or unpredictable funding needs.

How it works: Business lines of credit basically work like personal credit cards. That is, a fixed amount of capital is set which you can access when necessary. Interest rates are also paid on top of the borrowed amount. At times referred to as revolving credit lines, this type of funding can be accessed again once the previous loan amount is paid in full.

4. Short-Term Loans. Short-term loans are perhaps the easiest to understand as they are just a condensed version of long term or traditional loans. When it comes to short-term lending, the quicker the cash-out, the higher the interest rates.

How it works: Borrowers get a lump sum of money which is paid back within a specific period along with interest rates. Compared to its long-term equivalent, this type of loan has an earlier repayment schedule, lower loan amount, and more frequent remittance terms. Still, short-term loans are easier to access and require lenient qualifications.

How to Use Business Loans Wisely

Acquiring a business loan may not be a piece of cake, but when used wisely, it can be a powerful source for driving new business development. That is why it’s just as important to learn how to leverage financial assistance to boost your brand.

Here are 5 ways to use business loans wisely:

- Marketing Assistance

Marketing can introduce a local company into the international community. Unfortunately, budget limitations push this important facet of business in the back row. With borrowed funds, however, you can get the best marketing assistance for your brand.

From hiring a content writer VA (virtual assistant) to gain top website ranking in Google to invest in paid social media ads, capitalizing on targeted campaigns can increase both the website and foot traffic of your business. Because marketing is multi-faceted, it is best to build your own digital marketing team to boost brand-awareness in search, social media, and email.

- Inventory Restock or Expansion

Imagine getting a surge of orders and not being able to fulfill them. For one thing, you’ll fail to reap the fruits of your marketing efforts and miss out on sales; for another, people will think your company is unreliable and won’t take your future campaigns or promotions seriously.

Entrepreneurs must always make sure they have enough supplies to fulfill orders. Besides, there are also seasonal demands to consider where you need to purchase more materials than usual or get an extra pair of hands. When these things happen, don’t hesitate to borrow funds to fulfill your needs. When you use loans to tide you over the busiest times of the year, you are making the good kind of debt.

- Human Resource

Don’t let budget restraints keep you from building your personnel – especially when outsourcing to a virtual assistant is an option. There are multiple ways a virtual assistant can help your business, ranging from administrative work and customer service to bookkeeping and media creation.

When you hire a virtual assistant from a reputable staffing company, you get professional support at rates tailored for small businesses. There’s no need to fill different roles and risk getting substandard output when the right people can do the job at hand. Besides ensuring a smooth day-to-day operation, working with specialists like SEO and content VAs can increase business growth. That’s a sure way to get returns for your investment.

- Product or Service Extension

One proven way to win new customers is to add new goods or services to your current lineup. However, this move entails market and product research, product development, inventory purchase, and advertising – all of which require an adequate amount of money.

If your current budget won’t cut it, funding product or service extension can be possible with loans. With new listings, you can easily market or position your products through bundles, thereby increasing revenues.

- Customer Care

Customer care doesn’t often necessitate entrepreneurs to borrow funds. When businesses acquire a lump sum of capital, they usually funnel it to equipment or real estate investments. However, channeling your funds to customer-centric programs is a wise move.

For example, you’ve been getting recurring complaints of slow response time to customer inquiries. Use your money to hire an assistant to man your social pages, manage your inbox, or regulate website comments. Another example is investing in a user-friendly, mobile-adaptable online store with multiple payment options. Making sure your customers can shop conveniently and receive support promptly will keep them coming back.

Don’t bleed out your personal savings just to fund your business. Just as importantly, don’t limit your company growth because of budget constraints. Get financial e-commerce support from the right resources – and when you do, make sure to invest them wisely by keeping these takeaways in mind.