Small Business 101: Guide to Outsourced Accounting

If you’re a small business owner, you probably have a hand in numerous functions—from marketing, sales, and operations to finance and heaps more. Trying to keep track of everything can be tough, especially when you’re wearing multiple hats. That’s where outsourcing, particularly businesses that outsource accounting services comes in.

What is Small Business Accounting?

Small business accounting is the process of tracking, recording, and managing your company’s financial transactions. This includes everything from invoicing customers and paying suppliers to preparing tax returns and creating financial statements.

What is Outsourced Accounting?

Outsourcing accounting is the practice of delegating financial and accounting responsibilities to a third party.

Examples of Outsourced Accounting Services

There are a number of services that outsourced accounting firms can provide, such as:

- Bookkeeping services – These involve recording and categorizing financial transactions.

- Invoicing – This is the process of billing customers and clients for goods or services rendered.

- Payroll services – These include issuing paychecks, calculating taxes, and managing employee benefits.

- Financial report creation – This entails preparing and analyzing financial statements.

- Tax filing – This involves filing business tax returns.

- Other tax services – These can include tax planning, consulting, and representation.

- Auditing – This is the process of examining an organization’s financial records to ensure they are accurate.

- Financial planning – This involves creating a roadmap for the future financial success of a business.

- Customized management reporting – This service provides businesses with customized reports to help them make informed decisions.

- Advisory services – These can include providing advice on various financial topics, such as budgeting, cash flow management, and risk mitigation.

Looking for a Bookkeeping VA to help with business accounting? We’re here to help you! Book your FREE consultation with our Business Growth Experts.

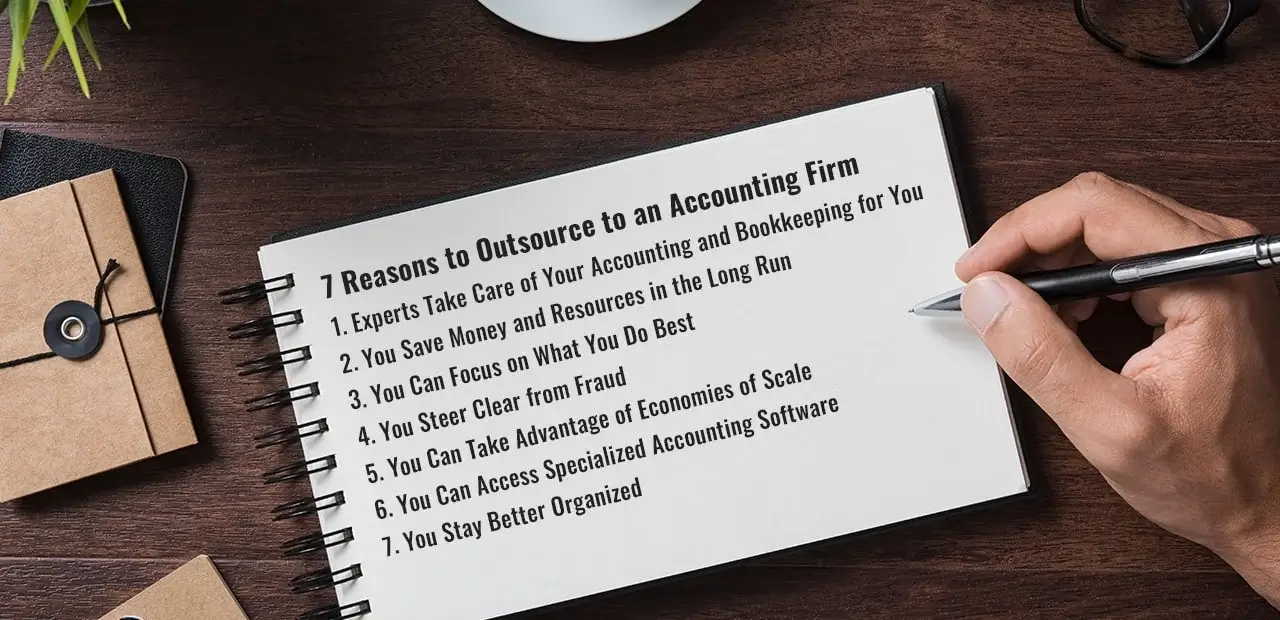

7 Reasons to Outsource to an Accounting Firm

One of the most common mistakes entrepreneurs make is underestimating their company. It might sound ironic, but many small companies fail to reach their full potential because of the restrictions set upon them by their owners.

One of these self-imposed restrictions is the belief that a company doesn’t need to outsource any facet of the business. This misconception does more harm than good because it robs the CEO or business owner of the time to expand, explore options for growth, and focus on matters that only a business owner can take care of.

There are many branches of a business that a small company can (and should) outsource but foremost is accounting. Here are several reasons why businesses should outsource accountants.

1. Experts Take Care of Your Accounting and Bookkeeping for You

When you outsource accounting tasks, you tap into the expertise of people who have been trained and educated in the accounting field. This is important because they know exactly what needs to be done and how to do it correctly.

This is a big advantage for small businesses because most small business owners are not accounting and bookkeeping services experts. They might have taken a few courses here and there, but they may not be well-versed in the ins and outs of accounting processes.

As a result, some business owners commit accounting or bookkeeping errors that cost them dearly in terms of penalties, interest, and fees. With outsourced accounting, you can be sure that your books are in good hands, especially if you work with a reliable accounting firm.

2. You Save Money and Resources in the Long Run

You might think that by outsourcing accounting, you’re spending more money than if you performed the accounting and bookkeeping tasks yourself. This isn’t always the case.

Outsourcing your company’s accounting processes to a dedicated team or accountant can help improve your bottom line by ensuring that your finances are in order and helping you make more informed decisions for future business development.

In addition, having an outsourced team of accountants who are familiar with your specific industry can be extremely helpful in ensuring that you’re taking advantage of all the resources, tax breaks, and deductions available to you. You don’t have to worry about hiring, training, and managing additional in-house staff, which can be costly.

By having an outside provider manage your books, you can be sure that all financial reporting is done in accordance with current regulations. This can save you a lot of money and headaches down the road, especially if you’re ever audited. At the end of the day, it’s important that the accounts receivable, accounts payable, and payroll are all efficient and compliant.

Confused, overwhelmed, and in need of help? We’ve got your back. Schedule a business growth consultation so we can talk today!

3. You Can Focus on What You Do Best

By outsourcing your accounting, you can focus on the core functions of your business and leave the number-crunching to the experts. Accountants have the training and experience to handle your financial needs, from bookkeeping to tax preparation. They can also help you stay compliant with government regulations and recommend strategies for growing your business.

There are more benefits to outsourcing your accounting tasks, such as reducing costs and freeing time for you and your staff. And because outsourced accounting is a professional service, you can rest assured that your financial data is always safe and secure. So if you’re looking to focus on running your business and remaining competitive (rather than worrying about its finances), outsourcing accounting processes is the way to go.

4. You Steer Clear of Fraud

By having a separate and objective accounting department that’s not affiliated with your company’s day-to-day operations, you help minimize the chances of fraudulent activities going undetected.

An experienced outsourced accounting team has the experience and industry expertise to flag any suspicious activity inside an organization. Outsourced accountants are often better equipped to detect financial irregularities than in-house accountants. Additionally, outsourced accounting firms typically have more rigorous auditing procedures, which can help further mitigate the risk of fraud. You’ll have peace of mind knowing that your company’s finances are in good hands, and there will be no business continuity disruptions.

5. You Can Take Advantage of Economies of Scale

Outsourced accounting lets you take advantage of economies of scale by using the latest technology and employing skilled staff in low-cost locations. Accountancy firms can offer a much more cost-effective accounting service than most businesses could achieve on their own. This is especially true when it comes to complex compliance work and international expansion.

Additionally, outsourced accounting can help you tap into new markets. Hiring an internal accounting department or bookkeeper doesn’t make sense for everyone. In fact, many small businesses choose to subcontract their work to save money. But did you know that outsourcing can also be a tool for business growth?

For example, suppose you’re looking to expand internationally. In that case, it may make sense to get outsourced accounting services from a firm that already has a presence in the country you’re looking to enter. This is a cost-effective way of setting up your own accounting systems and overall operations overseas. And because outsourced accounting firms typically have more robust systems and processes in place, they can scale up quickly to meet your needs as your business grows.

6. You Can Access Specialized Accounting Software

With outsourced accounting services, you can take advantage of the third party’s investment in the latest accounting software. These types of accounting software are expensive and constantly evolving, so it’s difficult for small businesses to keep up with the latest versions and features. But because accounting professionals and firms use this software on a daily basis, they can help you get the most out of it and ensure that your books are up-to-date.

Additionally, outsourced accounting service teams often have staff with specialized knowledge of various accounting software platforms. So if you’re using a complex system like QuickBooks or Xero, they can offer expert advice and support when you need it.

If you want to concentrate on the core functions of your business, you need an Administrative VA to help with your crucial day-to-day tasks. Make your life easier by hiring an Admin VA today!

7. You Stay Better Organized

Outsourced accounting firms can help you stay organized by implementing best practices and processes to keep your financial and accounting data accurate and up-to-date. This is especially important if you have complex compliance requirements or are expanding into new markets.

Additionally, outsourced accounting services can help you develop customized financial reporting solutions that will give you visibility into your business’s cash flow and overall financial health. This way, you can make informed decisions about where to allocate existing resources and where to cut costs. Having this information at your fingertips will help you run your business more efficiently and effectively.

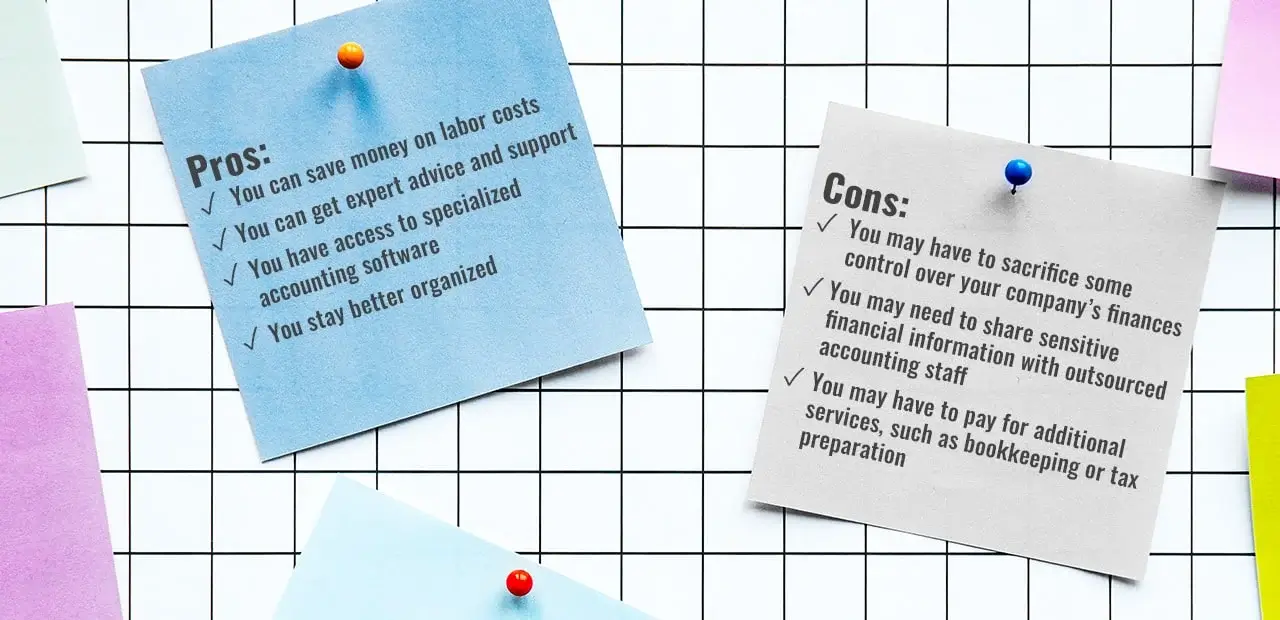

Pros and Cons of Outsourced Accounting Services

Now that we’ve covered outsourced accounting 101, let’s take a look at the pros and cons of an outsourced accounting team and its services.

Pros:

- You can save money on labor costs

- You can get expert advice and support

- You have access to specialized accounting software

- You stay better organized

Cons:

- You may have to sacrifice some control over your company’s finances

- You may need to share sensitive financial information with outsourced accounting staff

- You may have to pay for additional services, such as bookkeeping or tax preparation

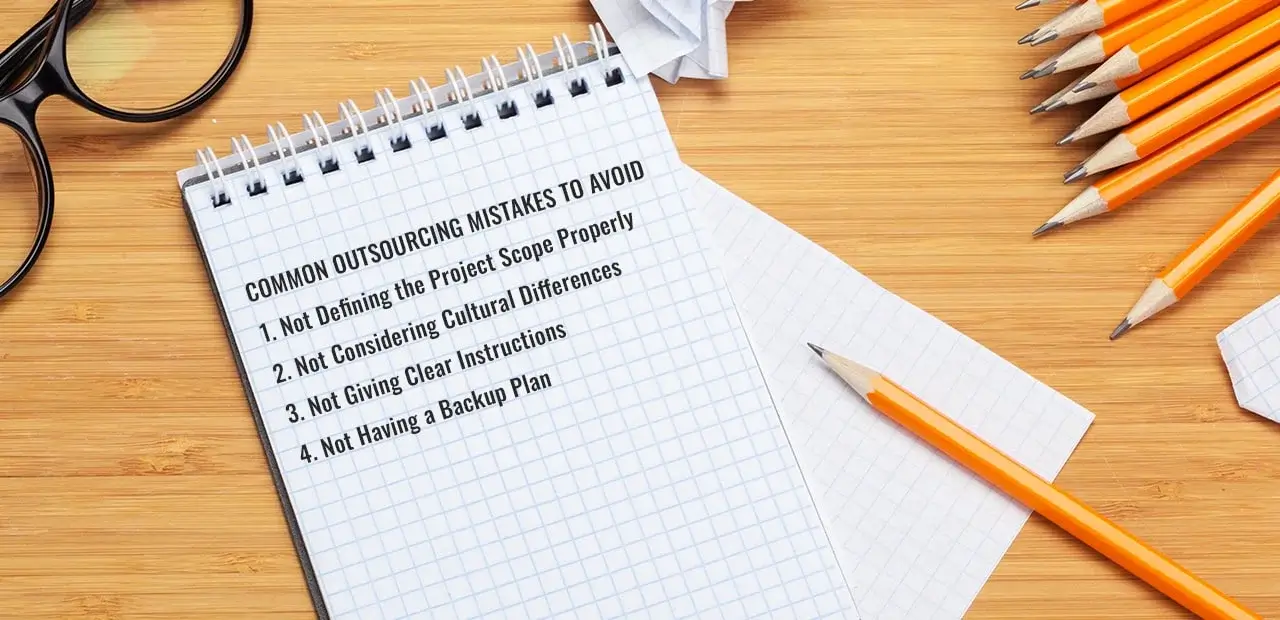

Common Outsourcing Mistakes to Avoid

When considering outsourced accounting services, it’s important to do your due diligence. Here are four of the most common mistakes to avoid when outsourcing:

1. Not Defining the Project Scope Properly

When companies outsource their business or accounting processes, it’s crucial to define the project’s scope properly from the outset. Not doing so can lead to misunderstandings and expectations not being met down the line. To avoid this, be clear about what you want from the start and make sure everyone involved is on the same page.

Provide your outsourced accounting team with key performance indicators (KPIs), so they know what success looks like and can be held accountable. This will help ensure that the team delivers on the wants and needs of the business. Additionally, make sure to set realistic deadlines for the project. This will ensure that both parties are happy with the result.

2. Not Considering Cultural Differences

Cultural differences and practices can often be obstacles when outsourcing accounting projects overseas. It’s important to consider how cultural norms may impact how outsourced staff members communicate and do business. For example, in some cultures, it’s considered rude to say no or to disagree with someone openly. This can make it difficult to give clear instructions or feedback.

Additionally, time zones can be a challenge when working with an outsourced accounting team in a different part of the world. Make sure to take this into account when setting deadlines and communicating expectations.

To avoid these challenges, it’s important to research and choose a service provider you feel will be a good fit for your company.

Are you missing appointments and getting schedules wrong? You need an Appointment Setter VA in your life. Explore the advantages of VA staffing and discover how VAs can be the secret to your success.

3. Not Giving Clear Instructions

When outsourcing, it’s important to give clear instructions and provide all the necessary information upfront. This will help avoid misunderstandings and improve efficiency by ensuring that the outsourced team has everything they need to do the job properly.

Before your outsourced accounting team starts work, prepare a detailed brief that outlines the scope of their tasks, deadlines, and expectations. You should also provide all relevant information, such as contact details, usernames and passwords, and any templates or style guides that must be followed.

Additionally, it’s important to set up regular check-ins and progress reports so that you can give feedback, ensure that the project is on track, and better manage the team.

4. Not Having a Backup Plan

When outsourcing, it’s important to have a backup plan in place in case things go wrong. This could include having a contract with clauses for early termination or delayed delivery. You should also consider what to do if the outsourced accounting team cannot meet the outlined expectations.

A backup plan can protect your business and avoid disruptions in case of unforeseen problems.

Summing It Up

Whether outsourced accounting is the right solution for your business depends on a number of factors. But if you’re looking to save money, get expert support, and stay organized, it’s worth considering.

Weighing the benefits of outsourced accounting services? Don’t dive headfirst into it. Do your research and only work with a reputable firm with a good track record. Once you’ve found the right outsourced accounting team, you’ll be on your way to exponential business growth.

Ready to scale your small business? Book your FREE, no-strings-attached consultation and discover what we can do for you.

Insightful and Very Interesting!!!!!!

Outsourcing accounting allows small business owners to focus on core activities while ensuring financial accuracy and compliance, ultimately driving growth.